MURDER, POLITICS, AND THE END OF THE JAZZ AGE

by Michael Wolraich

Came across this little tidbit in Huffington. Seems that the Stocks in socialized countries do much better that those here.

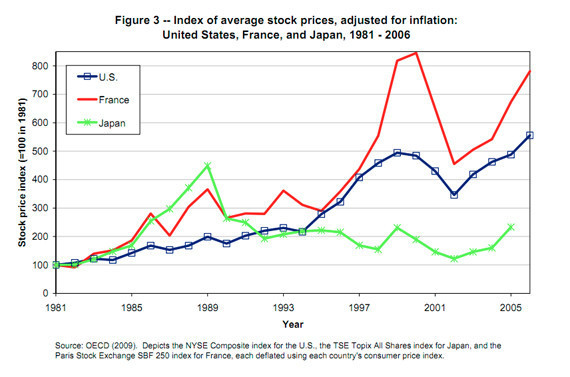

American traders aren't likely to take kindly to the suggestion that big government might be good for the stock market. But data from a paper on the job- and income-growth of top earners shows that stock prices in some socialized countries, relative to themselves and adjusted for inflation, have done considerably better than those in the U.S over the last two and a half decades.

Specifically, during the twenty five years after Ronald Reagan took office -- a pro-market honeymoon that Ryan Chittum of the Columbia Journalism Review this week termed "the ascent of laissez-faire economic policies" -- French stock prices have performed significantly better than Americans ones, according to the report by Jon Bakija, Adam Cole, and Bradley Heim.

A further examination of the 39-year period extending from the end of the Nixon administration until 2008 shows the Swedish economy, known for its high taxes and heavy regulation, growing at a significantly higher rate than the US.

Well like Gomer Pyle would say...Surprise ! Surprise ! And this chart gives a pretty good representation of this.

The graph below illustrates the annualised sharemarket returns for several major economies for the 39 year period ending 31 December 2008.

According to Jacob Funk Kirkegaard, a research fellow specializing in European economies at the Peterson Institute for International Economics, the disparity between the American and European markets might have more to do with the period in question than governmental forces.

"In 1981, [Francois] Mitterand was elected president of France, and the first thing he did was to nationalize a bunch of French businesses and most of the banking system," Kirkegaard explained. "But going forward, France has moved quite dramatically towards a market-oriented economy, though not anywhere near the scope of market and economic freedom as perceived in the U.S."

And seeing is believing.

You can download the pdf of the report here. It's pretty long but the Columbia Journalism Review has a good summery of it.

First, applaud the fact that the authors adjusted stock prices for inflation. That’s almost never done. They did it here by prices for each respective country.

The authors cut off the stock chart at 2006 because that coincides with the tax data they were studying. Since then, the U.S. stock market has done a little less worse than French stocks. And it seems as if the researchers just used index averages and not dividends in their calculations, which could change the (while I can’t seem to find historical data on French dividend yields, I’d guess they’re at least comparable to American ones).

But the point is, the ascent of laissez-faire economic policies in the U.S. during the first quarter century following the Reagan Revolution wasn’t enough to outdo French stocks, which faced the heavy hand of government.

Take it for what a single datapoint is worth, but it’s interesting, non? You don’t and won’t hear much about this one in the American business press. And you don’t even want to look at truly socialist Sweden’s stock returns, which have outpaced even France’s

And there you have it. The market does better in the socialist countries than it does here.

Comments

Very interesting. But who you gonna tell? We can't do anything about it and the people who could don't care. Still, very interesting.

Don't mean to be so flip after all your hard work. I'm just really sick of getting worthwhile ammunition like this only to watch it go nowhere. It's that word "socialist", I think. It slams more doors...

by Ramona on Fri, 06/24/2011 - 6:54pm

It's BS bias perpetrated long ago....sigh.

by cmaukonen on Fri, 06/24/2011 - 7:50pm

by Michael Maiello on Sat, 06/25/2011 - 11:29am

You are correct Destor. People forget about all the takes overs. Hostile and other wise. I guess they ran out of companies to chop up so they started to chop up mortgages and loans.

by cmaukonen on Sat, 06/25/2011 - 1:02pm